Last week we looked at the divestment movement, and how investments can do some serious environmental damage, but the truth is we live under capitalism and that’s not changing anytime soon. If, like Liz Lemon, you “want to do that thing rich people do where they turn money into more money,” but you also don’t want to ransack the planet like a Black Friday shopper at a Walmart, there is a way forward.

This week we’re talking about socially responsible investing (SRI), a pretty loose term that generally means investing with some ethical principles in mind. Often SRI is informed by Environmental, Social, and Governance principles (ESG), which consider things like emissions, pollution, and water use; treatment of employees and labour standards; and the number of women on a board (which correlates with better company performance, btw) and good separation between a CEO and board. (There aren’t many screens for racial diversity yet, but here’s hoping that’s coming.) Generally, ESG screens for negative factors, looking for companies that do less bad. This is what passes for a win under capitalism, trust me.

Socially responsible investing is pretty young, and right now ESG funds only account for about 1% of investments, but that share is expanding pretty fast: in 2019, investment in ESG funds increased four-fold from the previous year. That number’s only likely to increase, as 95% of millennials surveyed by investment company Morgan Stanley said they were interested in ESG. As we saw last week, the divestment movement is also picking up steam, and more and more people are asking more of their investments. Plus with research that shows socially responsible investing doesn’t mean sacrificing returns — and might even mean increasing them — the sector is poised for growth. And growth, of course, is what all investors are looking for.

Now, ESG is relative, and there is no standardized labelling system. So there’s no guarantee a fund labelled that way is squeaky clean, and it’s important to look closely. In his newsletter, Bill McKibben noted that a BlackRock ESG fund held a big chunk of ExxonMobil, which, he quips, “is roughly akin to the Vatican setting aside a corner of the Sistine Chapel for satanic rituals.” One of my strictest ESG funds still holds a small piece of the evil Amazon empire, as well as Coca-Cola and some major grocers we just discussed as #problematic. That said, there is no perfect investment, which is probably why anti-capitalist crusader Naomi Klein stays out of the stock market. (I’m curious how she’s saving for her retirement.) Be critical of what a fund contains, but don’t expect moral perfection: that way madness lies.

So if after last week’s newsletter you decided to unload some fossil fuel funds, or if you’re just starting out as an investor, let’s talk about how we can make our money multiply without selling out our values.

It’s important to note here that I’m not a licensed investment advisor, and I’m not going to be giving any specific fund recos. What I will do is set you up to learn more and figure out what avenue might be right for you.

This is a choose your own adventure situation, and there are three main pathways (none of which end in snake pits or UFO abduction):

Work with an investment advisor. This could be someone at a bank or a firm, though keep an eye on the fees they’re charging (usually a percentage of your returns, which can eat up a major chunk of your money in the long run), and make sure they’re aware of your values. You could also hire an independent fee-for-hire advisor, like Tim Nash of GoodInvesting (we have no relationship, I just like his approach) to help get you on the right track.

Get a robot to take care of it. We’ll get into this in more detail, but robo-investing is a great option for people who immediately recycle the business section of their newspaper and want this whole thing to work on autopilot. You’ll pay a small fee (0.25–0.5%) for this, but robots are much cheaper than people and often better at their jobs.

Do it yourself. Thanks to banks and platforms like Vanguard, Questrade, and Wealthsimple Trade, you can choose your investments and buy them yourself. This will give you the most control and means you’re not coughing up a percentage of your return, but it’s also the most work and requires enough know-how to select your own investments and keep a balanced portfolio.

Now, you don’t need my help with number 1, but let’s look a little more closely at numbers 2 and 3.

Robo-investing

Robo-investing platforms usually rely heavily on exchange-traded funds (ETFs), which don’t try to beat the market, they just try to mimic it, because markets have historically trended upwards. Instead of owning a share of one company (say, Apple), it’s a basket of hundreds or even thousands of companies. ETFs, endorsed by even legendary stock pickers like Warren Buffet, are like the everything bagel of investing: they’ve got a little bit of everything and are likely to leave you satisfied. You can also buy ETFs yourself, you just have to pick them. (We’ll get there in a minute.) What the robot can do for you is pick the ETFs, invest on an automatic schedule, balance the holdings in your portfolio, and adjust as needed. It also means you won’t get emotionally involved in your investing, which is key, because the same brains that make us doomscroll until our eyeballs dry out or eat a whole pint of ice cream probably shouldn’t be in charge of our future finances.

In Canada, I have robo accounts with two major platforms: Wealthsimple and Questrade. (If you decide these platforms are right for you, I’d love it if you supported me/this newsy by using those referral links to start an account.) I’ve been with WS for longer, and I’ve been very happy with it. It has a pretty, minimalist, and incredibly easy-to-use interface, which seems superficial but is incredibly rare in the investing world and helpful if you’re intimidated by the whole thing. They also have great communication: when something scary happens in the stock market, I know I’ll get an email from them explaining why I shouldn’t panic. Wealthsimple and Questrade have a little checkbox you can select if you want a socially responsible portfolio — easy peasy.

But why I’m especially keen on Wealthsimple lately is that they revamped their socially responsible portfolio and created their own funds, which have some uncommonly strict filters. There’s no coal mining or generation; nothing oil and gas related; no tobacco, gambling, or alcohol (aka “sin stocks”); no companies that violated a UN compact; and boards of directors had to be at least 25% female or have at least three women. They also knocked out the top 25% of carbon emitters in each industry. (If you want to be thorough, Tim Nash does a 40-minute YouTube review of the new portfolio.)

Questrade has a similar robo system, though they buy other funds rather than making their own. (In fact, one of the major holdings was in the old WS portfolio.) In the U.S., companies such as Betterment offer a similar service and an SRI portfolio.

DIY investing

If you have some solid know-how and want to be/are a DIY investor, you use a platform that lets you buy and trade yourself. That’s the easy part. What’s harder is figuring out what to buy.

Of course there are many financial factors to consider, but from an ethical perspective there are a few handy resources that can help you:

Sustainalytics has rankings for various companies. Some info is behind a paywall, but you can get basic ESG information.

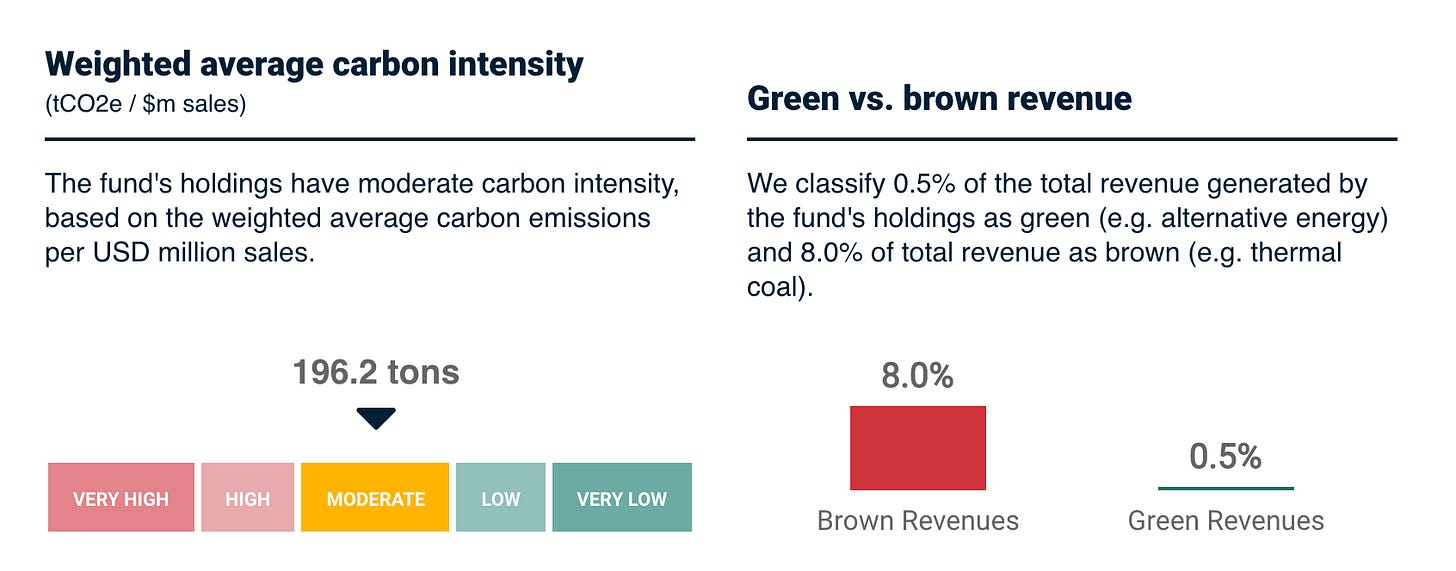

MSCI also has ESG ratings that will give you some basic data on a company and certain funds and show you how their rating has changed over time. Here’s an example from a fund commonly held in SRI accounts (including the Questrade one):

The Responsible Investment Association Canada (RIA) has a useful online tool that highlights funds according to specific filters, though they don’t give ratings.

As You Sow has analysis of U.S. funds that are categorized as fossil fuel free, prison industrial complex free, focused on gender equity, etc.

Corporate Knights publishes an annual top 100 list of the most sustainable companies.

Tim Nash has a bunch of sample portfolios listing specific ETFs over at SustainableEconomist.com.

Impact investing

So far we’ve been talking about doing less harm with our investments, but is it possible for our money to make more good? That’s “impact investing,” which directly invests in companies or organizations trying to raise capital. It can be a bit riskier but is a reasonable option for a smaller part of your investment portfolio, say 10–20%.

A lot of impact investing is in bonds — an amount of cash that you lend and get back with set interest over a predefined term, say 5% interest over five years. You often invest directly through that organization rather than through a bank or investing platform, so do your research to understand how they’ll pay your return and what risk is involved.

There are some exciting opportunities here. For example, you could help build solar power infrastructure with an organization like SolarShare or CoPower, or loan to farmers in Nova Scotia through FarmWorks. If this is something that interests you, check out OpenImpact’s database of impact investing opportunities in Canada.

You made it! Congratulations on surviving yet another newsletter on financial talk. (Next week I promise something light and breezy!) The investing world can be hugely intimidating, but as we saw last week, it’s also a big opportunity to do less harm and maybe even be a force for good.

I’ll admit, I hate this stuff, but I like having money, and so I’ve learned enough to get by. You can too! Basic investing knowledge is empowering, not to mention enriching. So set one goal you can crush, even if it’s just listening to a financial podcast (Money Moves is a short and sweet six-part investing series featuring the smart and loveable Melissa Leong), talking to an advisor, or looking into a robo account (which really are easy).

As a bonus, FMFP reader and green investing enthusiast Dave is happy to answer questions if you’ve got ’em! Hit me up with your questions and we’ll set something up.

TL;DR

Socially responsible investing (SRI) is a small but fast-growing area that screens funds or companies based on ethical principles often guided by Environmental, Social, and Governance assessments (ESG).

There’s no common labelling or standard for ESG, so look closely at any fund with that label.

For the easiest socially responsible investing, try a robo-advisor with a SRI portfolio, like Wealthsimple or Questrade in Canada or Betterment in the U.S.

If you’re a DIY investor, there are resources, such as MSCI or Sustainalytics, that can help you screen a fund or company.

Impact investing allows your money to do more good: look for funding opportunities at OpenImpact.

Wins of the Week

“We have to do the good that’s in front of us, even if it seems kind of meagre. Because that’s how things happen.” — Sharon Salzberg on the 10% Happier podcast

This week, some folks doing the good that’s in front of them:

After reading the newsletter on the environmental impact of data use, Lyn cleaned all those data burning promotions out of her inbox, and is unsubscribing from three emails a week.

Kerry refilled her shampoos and soaps in bulk!

Lindsay transformed her mealy peaches into relish — a delicious food waste win! (She also canned chilli sauce, red pepper jelly, and dilly beans like a boss.)

All these small actions can make positive ripples you may never see. Keep doing them, keeping talking about them, and keep reporting them to me! Your wins inspire others, and if I could hand out crisp merit badges, trust me I would.

As always, I love hearing from you — click reply, leave a comment, or get in touch on the socials.

xo

Jen

Five Minutes for Planet is written by me, Jen Knoch, and edited by the incredible Crissy Calhoun. Opening photo by Micheile Henderson on Unsplash